Table of Contents

The CBSE Class 12th Accountancy Sample Paper for the academic session 2024-25 is out on the official website of the Central Board of Secondary Education [CBSE]. All the students who are preparing for their final examinations and now download their sample papers for the Accountancy subject along with their answers using the direct links added below in the article.

These sample papers are the official test papers released by the CBSE following the latest exam pattern, syllabus change, and marking pattern to be followed for the final examination. Click on the direct links to download the year-wise CBSE Class 12 Accountancy Sample Paper.

CBSE Class 12 Accountancy Sample Paper 2024-25

The CBSE Board has released the Class 12 Accountancy Sample Papers at its official website which can be accessed by students to complete their preparation. Using these sample papers will offer students the opportunity to understand the types of questions being asked, exam patterns, marking schemes, time management, etc. The CBSE Class 12 Accountancy sample paper comprises of both short and long-type questions as asked in the main exam paper giving exam-like situations to the students. Overall, sample papers are important for exam preparation because they help students understand the exam pattern and content, while also improving their skills.

Class 12 Accountancy Sample Paper 2024-25 PDF With Solutions

The latest and updated sample papers of the Accountancy subject are available on the online portal so that all the students can download them and complete their preparations using them. Students going to appear in the CBSE board exam must complete their preparations only after solving and scoring higher in the CBSE Class 12 sample paper.

This will help them understand the new exam format and become familiar with the types of questions they may face. Regular practice will improve their preparation and boost confidence for the upcoming 2024-25 board exams. Make sure to go through the entire paper carefully.

| CBSE Class 12 Accountancy Sample Paper 2024-25 with Solutions | |

| Sample Paper PDF | Solution PDF |

| CBSE Class 12 Accountancy Sample Paper 2024-25 PDF | Solution Link |

CBSE Class 12 Accountancy Exam Pattern 2025

The CBSE Class 12 Accountancy exam has two parts: Part A and Part B. Part A focuses on Financial Accounting, while Part B includes Cost Accounting and Financial Statement Analysis. The theory exam is for 80 marks, and 20 marks are for practicals or projects. The paper has questions worth 1 to 6 marks, including short and long answers. While there’s no overall choice, some internal choices are given. These include 7 one-mark questions, 2 three-mark questions, 1 four-mark question, and 2 six-mark questions. Students should prepare thoroughly to answer a variety of questions in the exam.

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Part – A is compulsory for all candidates.

- Part – B has two options i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options.

- Questions 1 to 16 and 27 to 30 carry 1 mark each.

- Questions 17 to 20, 31and 32 carry 3 marks each.

- Questions from 21, 22, and 33 carry 4 marks each

- Questions from 23 to 26 and 34 carries 6 marks each.

Download Class 12 Accountancy Sample Paper PDF with Solutions (Previous Year)

To help Class 12 students prepare for their Accountancy exam, we have provided previous year’s sample papers along with solutions in PDF format. These papers are useful for practice and understanding important questions and their answers. Students can easily download them by clicking on the links given in the table. Practicing with these papers will boost their confidence and improve their performance in the exam. Make the most of these resources to complete your preparation and score well in the upcoming examination.

| CBSE Class 12 Accountancy Sample Paper | |||

| Year | Subject | Sample Question Paper (SQP) | Marking Scheme (MS) |

| 2023 | Accountancy | Click Here | Click Here |

| 2022 | Accountancy | Click Here | Click Here |

| 2021 | Accountancy (Term 1) | Click Here | Click Here |

| Accountancy (Term 2) | Click Here | Click Here | |

Class 12 Accountancy Sample Questions 2024 with Answers

PART A

(Accounting for Partnership Firms and Companies)

Q1. Anthony a partner was being guaranteed that his share of profits will not be less than ₹ 60,000 p.a. Deficiency, if any was to be borne by other partners Amar and Akbar equally. For the year ended 31st March, 2024 the firm incurred loss of ₹ 1,80,000. What amount will be debited to Amar’s Capital Account in total at the end of the year?

A. ₹ 60,000

B. ₹ 1,20,000

C. ₹ 90,000

D. ₹ 80,000

Answer: B- ₹ 1,20,000

Q2. Assertion: Partner’s current accounts are opened when their capital are fluctuating.

Reasoning: In case of Fixed capitals all the transactions other than Capital are done through Current account of the partner.

A. Both A and R are true and R is the correct explanation of A.

B. Both A and R are true but R is not the correct explanation of A.

C. A is true but R is false

D. A is false but R is true

Answer: D – A is false but R is true

Q3. Forfeiture of shares leads to reduction of _________________Capital.

A. Authorised

B. Issued

C. Subscribed

D. Called up

OR

Q3. Moon ltd. issued 40,000, 10% debentures of ₹100 each at certain rate of discount and were to be redeemed at20% premium. Exiting balance of Securities premium before issuing of these debentures was ₹12,00,000 and after writing off loss on issue of debentures , the balance in Securities Premium was ₹2,00,000. At what rate of discount these debentures were issued?

A. 10%

B. 5%

C. 25%

D. 15%

Answer: C – Subscribed

OR

Answer: B – 5 %

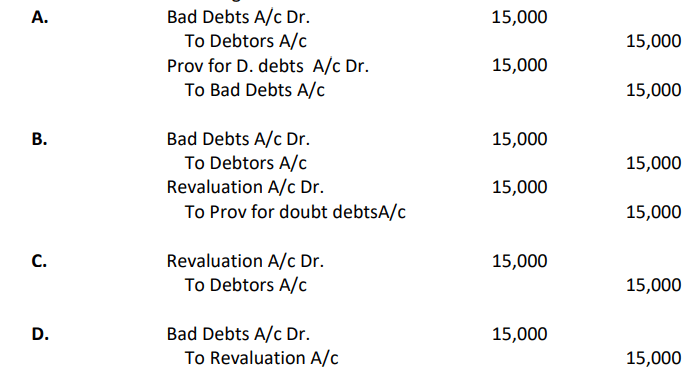

Q4. At the time of admission of new partner Vasu, Old partners Paresh and Prabhav had debtors of ₹ 6,20,000 and a provision for doubtful debts (PDD) of ₹ 20,000 in their books. As per terms of admission, assets were revalued, and it was found that debtors worth ₹ 15,000 had turned bad and hence should be written off. Which journal entry reflects the correct accounting treatment of the above situation?

OR

Q4. Ram and Shyam were partners sharing profits and losses in the ratio of 3:2. Their balance sheet shows building at ₹ 1,60,000. They admitted Mohan as a new partner for 1/4th share. In additional information it is given that building is undervalued by 20%. The share of loss/gain of revaluation of Shyam is ____________ & current value of building shown in new balance sheet is _______.

A. Gain ₹ 12,800, Value₹ 1,92,000

B. Loss ₹ 12,800, Value₹ 1,28,000

C. Gain ₹ 16,000, Value₹ 2,00,000

D. Gain ₹ 40,000, Value₹ 2,00,000

Answer: [A]

OR

Answer: C – Gain ₹ 16,000, ₹ 2,00,000

Q5. The profit earned by a firm after retaining ₹ 15,000 to its reserve was ₹ 75,000. The firm had total tangible assets worth ₹ 10,00,000 and outside liabilities ₹ 3,00,000. The value of the goodwill as per capitalization of average profit method was valued as ₹ 50,000. Determine the rate of Normal Rate of Return.

A. 10 %

B. 5 %

C. 12 %

D. 8 %

Answer: C – 12 %

Q6. Mohit had applied for 900 shares, and was allotted in the ratio 3 : 2. He had paid application money of ₹ 3 per share and couldn’t pay allotment money of ₹ 5 per share. First and Final call of ₹ 2 per share was not yet made by the company. His shares were forfeited. The following entry will be passed

Share Capital A/c Dr. X

To Share Forfeited A/c Y

To Share Allotment A/c Z

Here X, Y, and Z are:

A. ₹ 6,000; ₹ 2,700; ₹ 3,300

B. ₹ 4,800; ₹ 2,700; ₹ 2,100

C. ₹ 4,800; ₹ 1,800; ₹ 3,000

D. ₹ 6,000; ₹ 1,800; ₹ 4,200

OR

Q6. A company forfeited 6,000 shares of ₹ 10 each, on which only application money of ₹ 3 has been paid. 4,000 of these shares were re-issued at ₹ 12 per share as fully paid up.

Amount of Capital Reserve will be _______.

A. ₹ 18,000

B. ₹ 12,000

C. ₹ 30,000

D.₹ 24,000

Answer: B- ₹ 4,800; ₹ 2,700; ₹ 2,100

OR

Answer: B -₹ 12,000

Q7. On 1st April 2019 a company took a loan of ₹80,00,000 on security of land and building. This loan was further secured by issue of 40,000, 12% Debentures of ₹100 each as collateral security. On 31st March 2024 the company defaulted on repayment of the principal amount of this loan consequently on 1st April 2024 the land and building were taken over and sold by the bank for ₹70,00,000. For the balance amount debentures were sold in the market on 1st May 2024. From which date would the interest on debentures become payable by the company?

A. 1st April 2019.

B. 31st March 2024.

C. 1st April 2024.

D. 1st May 2024.

Answer: D – 1st May 2024

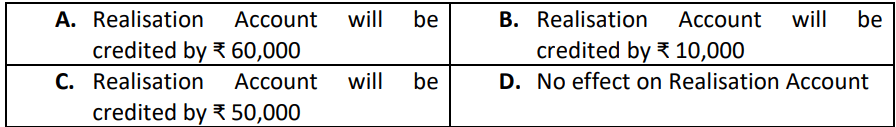

Q8. Rama, a partner took over Machinery of ₹ 50,000 in full settlement of her Loan of ₹ 60,000. Machinery was already transferred to Realisation Account. How it will effect the Realisation Account?

OR

Q8. Dada, Yuvi and Viru were partners sharing profits and losses in the ratio 3:2:1. Their books showed Workmen Compensation Reserve of ₹ 1,00,000. Workmen Claim amounted to ₹ 60,000. How it will affect the books of Accounts at the time of

dissolution of firm?

A. Only ₹ 40,000 will be distributed amongst partner’s capital account

B. ₹ 1,00,000 will be credited to Realisation Account and ₹ 60,000 will be paid off.

C. ₹ 60,000 will be credited to Realisation Account and will be even paid off. Balance ₹ 40,000 will be distributed amongst partners.

D. Only ₹ 60,000 will be credited to Realisation Account and will be even paid off

Answer: A – Realisation Account will be credited by ₹ 60,000

OR

Answer: C- ₹ 60,000 will be credited to Realisation Account and will be even paid off. Balance ₹ 40,000 will be distributed amongst partners

CBSE Class 12 Biotechnology Sample Paper...

CBSE Class 12 Biotechnology Sample Paper...

CBSE Class 12 English Sample Paper 2024-...

CBSE Class 12 English Sample Paper 2024-...

CBSE Class 12 Computer Science Sample Pa...

CBSE Class 12 Computer Science Sample Pa...